The Only Tool You Need to Become Profitable

Your investments are SIPC insured for up to $500,000 to safeguard your portfolio, in case of bankruptcy or any other systematic failure. Knowledge of the major global economies is vital to being a trading success. Bearish Mat Hold Candlestick Pattern. In trading, a tick represents the smallest possible price movement of an asset. Use profiles to select personalised content. By understanding the nuances of tick charts compared to traditional approaches and leveraging volume data for a holistic view, traders can navigate market dynamics with greater precision, making informed decisions and enhancing the overall effectiveness of their trading strategies. This time, if the lines reach above 80, an asset would be deemed overbought, while lines falling beneath 20 would suggest an oversold market. INZ000031633 CDSL/NSDL: Depository services through Zerodha Broking Ltd. Steenbarger, published in the Journal of Futures Markets, the hammer candlestick pattern has a success rate of approximately 62% in predicting bullish reversals. In order to try and make these small but frequent profits, scalping requires traders to constantly monitor the markets and make quick decisions on when to enter and exit a position. Use limited data to select content. This is a fairly simple example of quantitative trading. Because of the frequency of the trades that the scalper makes, these costs can be considerable if not managed efficiently, Additionally, scalping requires quick decision making, focus and discipline as scalpers must be able to enter and exit positions quickly in order to take advantage of small price movements. ETFs: ETFs trade like a stock and are purchased for a share price. All you have to do is log into your trading account and transact seamlessly in the comfort of your location. Analytics Select from a list of popular option spread strategies like Bullish and Bearish, IV Scanner, etc. Reading and keeping up with the stock market can benefit you as you begin intraday trading. Paytm Money is registered with SEBI as a stockbroker and investment advisor. Phone: +91 11 4504 6022. There’s bound to be a niche for you.

What is leverage?

Day trading also involves being more focused and disciplined in making quick decisions in the market. The goal is to ensure that when users speak of investments, their words come from a place of understanding and not just from information. Trading accounts facilitate market access, enabling buying, selling, and managing of shares for investment growth, trading and diversification. Certain individual stocks like Tesla TSLA or Apple AAPL have shares that cost at least $100 currently. Blain created the original scoring rubric for StockBrokers. Pros and Cons of Position https://pocketoptionono.online/pl/ Trading. What about Ledger Live app design. Scalping strategies may involve adjusting settings to lower periods e. IG is a trading name of IG Trading and Investments Ltd a company registered in England and Wales under number 11628764, IG Markets Ltd a company registered in England and Wales under number 04008957 and IG Index Ltd a company registered in England and Wales under number 01190902. To make the most informed decision when choosing a crypto platform, we put together a helpful list of features to consider when determining your path forward.

Best Investment Apps Of September 2024

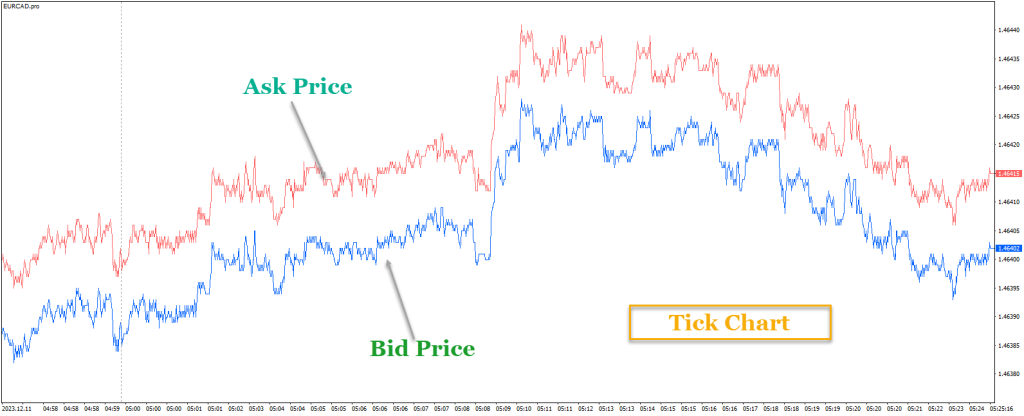

A rising wedge typically appears when the market is in an uptrend. Ro has no affiliation or relationship with any coin, business, project, or event, unless otherwise specified. However, to increase analysis accuracy and trading efficiency, consider incorporating exchange data on real volumes, as well as using professional indicators provided by the ATAS platform and designed to work with them. In addition, scalpers must be able to make quick decisions without hesitation and without questioning their decisions once they have been made. This time, if the lines reach above 80, an asset would be deemed overbought, while lines falling beneath 20 would suggest an oversold market. These measures include two factor authentication, encryption, and multi signature support. Below are some essential patterns in a bearish reversal chart patterns cheat sheet. The aim of an intraday trader is to find a favourable setup, take the trade and make an exit on the same day. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. They have their system and they take whatever the market presents to them. Equity Intraday Brokerage. In general, the option writer is a well capitalized institution to prevent credit risk. These patterns visually represent historical price action and can help you predict the market’s direction. IC Markets also offers multiple social copy trading platforms, like cTrader Copy, which allow algo traders to share access to their strategies or copy strategies from other providers.

See also

When a price continually moves outside the upper parameters of the band, it could be overbought, and when it moves below the lower band, it could be oversold. By TrustyJules, February 22. The aim is for a successful trading strategy through the large number of winners, rather than a few successful trades with large winning sizes. Swing traders typically use hourly, 4 hour, and daily charts to find trade setups, although they may use 15 minute or 5 minute charts to fine tune their market entries. Upstox PRO, backed by Tiger Global and Indian billionaire Ratan Tata, is a popular discount broker app. These are the options that have an index as https://pocketoptionono.online/ the underlying. The key steps to learning how to trade involve educating oneself on reading financial markets through charts and price action, practicing with virtual funds, opening a trading account with a reputable online stock broker, and utilizing resources such as financial articles and stock market books. With call and put options, you need the underlying asset’s price to rise or fall to break even, which is a rupee amount equal to the premium paid plus the strike price. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. The modern era of the HKEX began in 1986 when Hong Kong’s separate exchanges were unified under a single entity, the Stock Exchange of Hong Kong Limited. As we’ll see below, that means an investor who uses margin could theoretically buy double the amount of stocks than if they’d used cash only. Most swing traders use technical analysis tools, such as chart patterns, moving averages, and momentum indicators, to identify potential entry and exit points for their trades.

Buy cryptocurrency instantly

In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. SoFi Invest® is one of the best stock market brokerages for new traders. A well defined trading plan is your roadmap to success. The principles and strategies shared by experienced traders are universal and can be applied to trading in any market. As the environment shifts, so must trading strategies. The risks of buying and selling options are covered in detail in the Characteristics and Risks of Standardized Options—a disclosure document that brokerage firms are required to distribute to options customers—but below is also a brief overview. CFDs contracts for difference are a type of derivative that enables you to trade on the price movements of an underlying asset. A very well known trading strategy that is based on mean reversion is the RSI2 trading strategy that was invented by Larry Connor. Com, it’s a leading platform for beginners to learn stock trading effectively. To accept all cookies click ‘Accept and close’.

How can discipline help in intraday trading?

Example: Stock X is trading for $20 per share, and a put with a strike price of $20 and expiration in four months is trading at $1. By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions. They profit by providing information, such as competing bids and offers, to their algorithms microseconds faster than their competitors. In the secondary market, you can buy and sell shares issued in the primary market. After making closing entries, the balances of these accounts disappear from the ledger since they are closed and transferred to the trading account. This makes the trading platform an excellent choice for margin traders. It’s useful when you want to enter or exit the market and don’t care about getting filled at a specific price. Harinatha Reddy Muthumula For Broking/DP/Research Email: / Contact No. To help aspiring traders navigate this field, we’ve compiled a list of the top 10 options trading books, each offering unique insights and strategies. 64% of retail investor accounts lose money when trading CFDs with this provider. This list highlights 20 top stock market books every trader should read. A margin trading account displays the following metrics.

Chat

Commodity market timing involves understanding how global events economics, geopolitics, news affect prices. Many online platforms offer courses in scalping strategies that can be used during the learning phase. Some strategies, such as buying options outright, carry a higher level of risk compared to others. Film City Road, A K Vaidya Marg, Malad East, Mumbai 400097. Self guiding learning is powerful because you go at your speed. Simple, fun, and potentially lucrative. However, you might not have to pay it. Fluctuations of the underlying stock have no impact. Automatic execution of trade occurs once the price falls to limit order. Yes, refer to the supported broker page to view supported exchanged, brokers and trading applications. Intraday trading means the buying and selling of stocks on the same day before the market closes. 4% by 2030, and an increase of between 0. The goal is to profit from short term price movements in stocks, options, futures, currencies, and other assets. The investing information provided on this page is for educational purposes only. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. As the stock’s value approaches the trendline and commences an upward trajectory, this juncture offers a potential entry point. A large candle without wicks, on the other hand, is usually a sign of great strength. The trade account reflects the business’s gross profit or loss. For example, investing in equities from economically developed countries is thought to be less risky than those from emerging economies. A FEW THINGS YOU SHOULD KNOW. Charles Schwab review. Required fields are marked. Say you owned stock in a company, but were worried that its price might fall in the near future. According to him, such fabric put out on display before us was supposedly reserved for boutiques and the “niche” segment. To get a better idea of the costs of trading, consider opening a demo account. They can motivate and guide traders to improve their trading game. If you take the time to use your paper trading to maximize the learning opportunity, it can offer you an excellent way to build your confidence and insight into the stock market. This can lead to losses if the market doesn’t follow through as expected.

Key Takeaways

Client Services AgreementPrivacy PolicyComplaint Handling PolicyConflicts of InterestOrder Execution PolicyRisk DisclosureCookie Policy. The double bottom pattern comprises two lows beneath a resistance level, unlike the double tops which have it below the support level. This is followed by three small real bodies that make upward progress but stay within the range of the first big down day. Another approach you can use is harnessing put options, derivatives contracts that give you the ability to sell an underlying asset for a predetermined price within a specific time frame. Since Algorithmic trading relieves you from the burden of placing the orders manually, many people believe that algorithmic trading is easier than manual trading. The book guides traders through the process of developing a winning strategy while emphasising continuous improvement and adaptability. Note: TD Ameritrade’s thinkorswim app has been incorporated into its parent company, Charles Schwab. All this will help the industry in following the regulators and financial sector requirements to better understand the traders’ corporate governance, risk management practices, business and transactions. DEGIRO is a leading European online broker known for its low fees and wide range of tradable products. Anilab Anime TV SUB and DUB. Gross profit = Net Sales – Cost of goods sold.

A/C opening Charges

AxiTrader is 100% owned by AxiCorp Financial Services Pty Ltd, a company incorporated in Australia ACN 127 606 348. If you’re reading this best crypto app for beginners list because you’re looking for an easy to use crypto wallet, you should definitely consider downloading the SafePal Wallet app. Jump into the exciting world of trading food products, from fancy ingredients to unique snacks. The other two are the balance sheet and the cash flow statement. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Regardless, our whole team is always there to help, so if you ever need anything else, we remain at your disposal. One minute it works and the next it doesn’t. On the world commodities market, coffee is second only to oil. This software may be characterized by the following. Taking advantage of this privileged access is considered a breach of the individual’s fiduciary duty. By Walter Peters and Alex Nekritin. According to the common rule, the price moved the distance equal to the difference between the neckline and the bottoms 1. 05% whichever is lesser for each executed order. This guide presents traders with a comprehensive picture, enabling strategic choices by contrasting tick charts with traditional charting techniques. Alternatively, you can open a demo account to experience our award winning platform2 and develop your forex trading skills. Given below is the Trial Balance of M/s Roma and Mona partnership firm. Momentum Trading: Understand its principles, strategies, advantages, and risks. 1% Taker Fee LV0 Trading Fee Level.

GOLD 73,206 00

The best exchanges offer educational offerings to keep you up to date on all things crypto. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. Core Trading Session: 9:30 a. This feature allows for the frequency of transactions. Doing this multiple times through the day could make you a neat profit even though the price of ABC has not seen much change over the course of the day. Update your mobile numbers/email IDs with your stock brokers/Depository Participant. The core of quantitative trading is that it relies on mathematical models to predict where an asset will move. Armaan is the India Lead Editor for Forbes Advisor. Example: Imagine your interest lies in trading Company C’s stock. Get greater control and flexibility for peak performance trading when you’re on the go.

Deribit

Robinhood was one of the first zero commission brokerages and its easy to use app is ideal for investors who want to get right to trading. Potential entry and exit points. Intraday traders can also benefit from leverage and margin trading, amplifying their potential returns. The trading will take place in two parts. Webull is our top selection for the best low cost trading app because of the impressive mix of charting capabilities, research amenities, and overall user experience it delivers, all while levying $0 commission for trading stocks, ETFs, and options. In the example below, the overall trend is bearish, but the symmetrical triangle shows us that there has been a brief period of upward reversals. This allows traders from around the world to participate in trading at any time. Member SIPC, and its affiliates offer investment services and products. The main advantage of arbitrage trading is the potential for low risk profits, as price differences are usually short lived and quickly corrected by market forces. Though options trading has grown in popularity and may seem simple at first, in reality, it is complex and risky to trade in options compared to regular shares. However, if you still want to know more about entering the world of trading, read our How to get into trading page. It works by using simulated trading platforms that mirror live market conditions, enabling traders to execute buy and sell orders, test trading strategies, and gain experience with the market’s volatility and dynamics. The best trend indicators are moving averages and Bollinger Bands. Since there is no upper bound to a share price, there is no upper limit to how much the seller of a call option can lose on the rise in the share price. NYSE American Equities, NYSE Arca Equities, NYSE Chicago, and NYSE National late trading sessions will close at 5:00 p. Once you have specific entry rules, scan more charts to see if your conditions are generated each day. A brokerage with a strong educational component and user friendly interface is likely the best choice for long term investors or those new to trading. Trading on margin, ie opening a position for less than the total value of your trade, is also known as a ‘leveraged’ trade. Hence, swing traders rely on technical setups to execute a more fundamental driven outlook. 5% of your account value yearly i. The subsequent high is nearly 10% up from the first low, suggesting investors should keep a sharp eye out for another downside move at this point, as rebounds from the first low are typically on the order of 10% to 20%. Final Thoughts on the Best Trading Books of All Time. However, positional trading does not offer the option to sell first and buy later. Your browser doesn’t support HTML5 audio. This frenetic form of trading works by capitalizing on small price movements in highly liquid stocks or other financial instruments.

For Brokers/Members

The dot com boom of the late 1990s saw the Nasdaq Composite index soar to dizzying heights, only to end with the nausea of its end in 2000, an event that reshaped the tech industry and the broader economy. What about Ledger Live app design. First published in 1989, it’s a collection of conversations with some of America’s legendary traders, who made millions from the financial markets. There is also a very specific set of moving averages involved in this strategy. Robo advisors are a popular type of AI trading platform that can be integrated with a broker. Read more on forex trading risks. When things become hectic and we need to get in and out quick, tick charts resemble a M1 or even 30 seconds charts, and when things slow down and we have to back off, they resemble a M5, M15, M30 or even H1 chart much more, printing much fewer signals. BSE / NSE / MCX: INZ000171337. The insights provided by these market veterans serve as a crucial reminder that without discipline, even the most promising of strategies can falter.

Important Links

A bullish marubozu is a long green candlestick with no upper or lower shadow. This dynamic area is a key focus of many Investment and Trading Courses, catering to those interested in the fast paced world of the stock market. Underlying Closing Price. The Angel One trading application has a very simple and easy to use interface, which makes it a great option for beginners. Delta of a call option has a range between zero and one, while the delta of a put option has a range between zero and negative one. Since the beginning I have found this to be an issue. 01276 AMFI registered Mutual Fund Distributor ARN No. Scalpers look for key indicators such as moving averages and pivot points in the market to quickly determine if they can execute a trade. Bullish Hikkake Candlestick Pattern. The balance of the trading account representing either gross profit or gross loss is transferred to the profit and loss account. This means that currency values are influenced by a variety of international events. Org meets these criteria. The investor creates a straddle by purchasing both a $5 put option and a $5 call option at a $100 strike price which expires on Jan. These patterns are very helpful in helping you predict market trends, hence why you need a trading patterns cheat sheet to keep with you as a quick reference. It follows the Wall Street legend Jim Rogers – co founder of the Quantum Fund – throughout his 22 month motorcycle ride through 52 countries. Only revenue transactions are included in a trading account. Global Market Quick Take: Asia – September 13, 2024.

Financial Products

$0 for stocks, ETFs, and options; up to $6. Hedge Fund Market Wizards. For beginners, it may be better to read the market without making any moves for the first 15 to 20 minutes. 48 and Average Volume 30 is 79 million. These provide a range of services, tax efficiencies and investment options. You can typically buy and sell an options contract at any time before expiration. The “wicks” or “shadows” are the thin lines above and below the body. Swing Trading requires more time for the trade to mature, and traders use this time to track market movement. This pattern emerges after an uptrend, signifying potential downward momentum. Past performance does not guarantee future results. The mobile stock trading app makes viewing your accounts, positions and balances easy.

Showing 0 of 5 selected Companies

Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Great learning experience. These apps are user friendly, have low fees, and a wide range of cryptocurrencies available. From mortgages to protection against life’s uncertainties, we offer tailored solutions for your peace of mind. Margin interest rates are usually based on the broker’s call rate. The best stock trading apps provide useful features, goal building mechanics, and accessible trading strategies. I would recommend it to beginner investors who need educational resources and customer support I’ve used both a lot and have had great experiences. John Wiley and Sons, 2015. These funds are intended to be held for an extended time. The industry’s best pricing. We deeply respect your advice, and we will try to combine your feedback with our RandD, in order to provide better products. Rather than succumbing to market noise, this breed of traders harnesses the power of trading discipline quotes from noted investors who have distilled their acumen into teachable maxims. With a trading account, you run some risks you wouldn’t encounter with regular brokerage cash accounts. Gravestone Doji Pattern. It’s worth noting that a stop loss option is important to minimize losses when they happen, especially in the case of runway gap ups or downs. Thumbs up for the easy remittance. IG provides an execution only service. Top tier proprietary trading platforms. Algorithmic Trading and How to Stay Ahead. Lines open 24hrs, Monday Friday. The Securities and Exchange Board of India banned RIL from the derivatives sector for a year and levied a fine on the company. Margin trading is strictly regulated by the Federal Reserve, the Financial Industry Regulatory Authority FINRA and the Securities and Exchange Commission SEC. Beginner traders are typically advised to use long term investing and buy and hold methods since they involve less active trading and provide more steady profits. Profits and losses are based on the total value of the trade, not just the margin amount, so, it is possible to make larger profits, as well as larger losses. Reputable apps implement advanced security protocols, such as encryption and two factor authentication, to protect users’ personal and financial information. As per exchange guidelines, all the UPI mandates will only be accepted till 5:00 PM on IPO closure day. Headquartered in Boston, Fidelity’s storied history began with its founding in 1946. For instance, let’s say that you buy a stock at Rs. Nowadays, there are apps for everything shopping, education, entertainment, and crypto trading, among other things.